This article, written by Alex Simalabwi, Executive Secretary of Global Water Partnership Africa Coordination and CEO of the AIP, was first published in the AMCOW Africa’s Voices of Water 2024 magazine (download in full here).

The Sustainable Signals report published by Morgan Stanley earlier this year points to growing momentum in positive investor sentiment towards the water sector. African governments and their development partners must take urgent steps to improve the enabling environment to attract institutional capital into climate-resilient water and sanitation investments and capitalise on this trend.

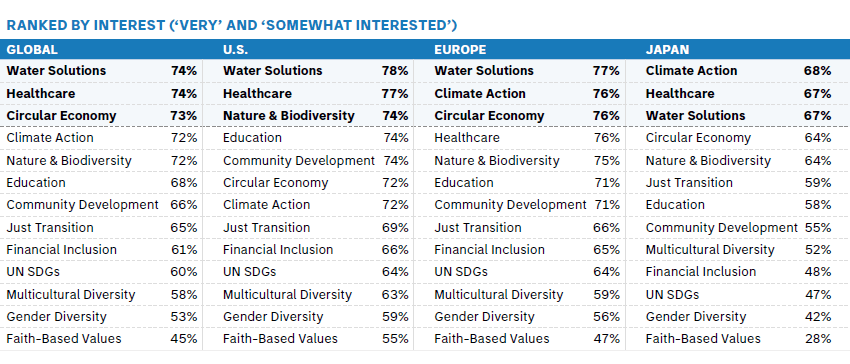

According to Morgan Stanley, more than three-quarters (77%) of global investors are interested in sustainable investing, and “water solutions” was ranked number one in terms of sustainable investment themes investors were most interested in. The asset manager defines water solutions as “investing in companies or funds that are developing solutions to ensure access to clean water and sanitation and restricting investment in companies that are significantly adding to the problem.”

Source: Sustainable Signals 2024, Morgan Stanley

The African Union’s Continental Africa Water Investment Programme (AIP) estimates that an additional US$30bn per year by 2030 is required to realise the water-related SDG targets on water security, sustainable sanitation, and many of its social and economic ambitions. Simply put, Africa’s population growth and economic potential cannot be sustained at current levels of investment into water and sanitation – US$10-US$19 billion annually. Already, Sub-Saharan Africa loses 5% of its GDP annually – around US$170 billion per year – because of a lack of water, contaminated water, or poor sanitation. The cost of inaction is too great.

Water security in Africa will increasingly rely on private finance, given the insufficiency of public funds and the private sector’s potential contribution to water business efficiency. The High-Level Panel Report for the AIP, Africa’s Rising Investment Tide report, published in 2023 by the African Union Commission and International High-Level Panel on Water Investments for Africa, found that if domestic pension funds could be mobilised as well as other institutional investors, an additional US$10 billion a year could be mobilised for water security.

However, to attract finance, the appropriate financial regulations and instruments must be in place. We see how a favourable investment environment benefits African infrastructure: investors have as much as US$550 billion in assets under management, but water projects are at the losing end due to a weak investment case and inadequate investment-ready projects.

Despite available finance and clear needs, few prepared projects result in a financial close due to low technical capabilities and limited financial resources dedicated to early-stage project development, feasibility studies and business plans. McKinsey terms this as ‘Africa’s infrastructure paradox’.

Bankable projects that have an appropriate risk-return profile should seek finance from the private sector and not receive government subsidies. In the case of near bankability, a blended finance mechanism could be used to attract investors.

International and domestic private finance can play a central role in closing the finance gap for water security and sustainable sanitation, with potentially trillions of dollars available in global markets.

The African Union’s Africa Water Investment Action Plan, published in support of the Continental Africa Water Investment Programme suggest the following action steps to attract institutional investors to the water sector:

- Commit to implementing conducive laws, policies, regulations and financial instruments;

- Gain an understanding of institutional investors, and initiate dialogue to develop relationships and trust;

- Strengthen overall financial sector regulation;

- Develop project pipelines that meet industry standards and include bundling options for scale;

- Adopt good practices on institutional investment PPPs legal framework in the first tranche of PPP deals;

- Sensitise users on the value of water and the need to adjust tariffs to better reflect costs;

- Support matchmaking platforms and investment forums to bring together the supply and demand for water finance with a special focus on climate resilient, blended finance, inclusive and gender transformative approaches;

African governments play a pivotal leadership role in influencing the enabling environment for water investments. The African Union’s AIP is committed to working with governments to develop national water investment programmes and an enabling investor environment. A water-secure Africa by 2030 is possible and within our power.

Photo by Simon Berger: https://www.pexels.com/photo/waterfalls-757142/